Incentive Under Section 127

I enter x in the box for the type s of incentive.

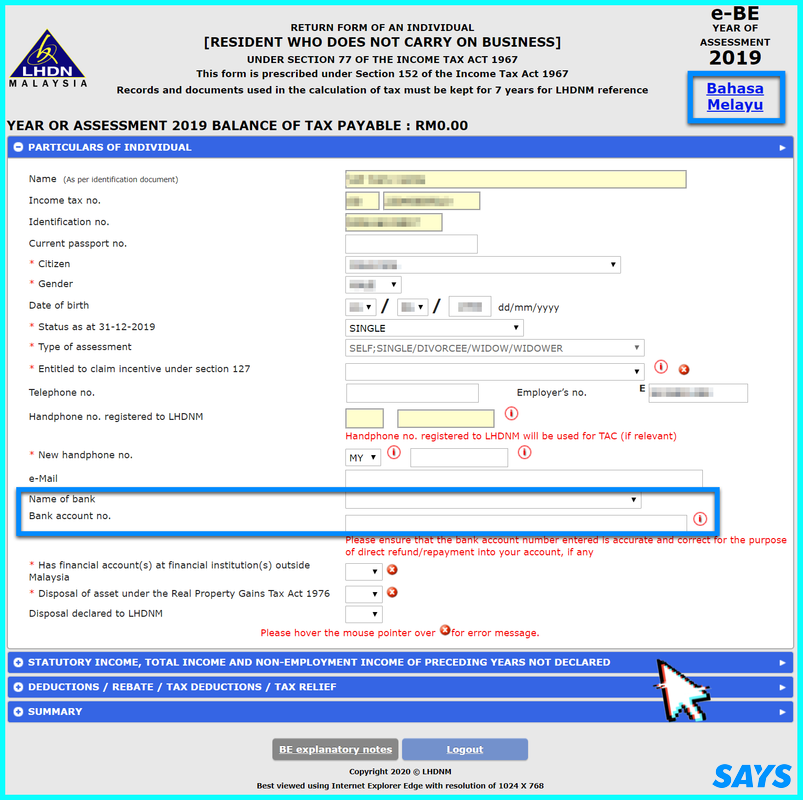

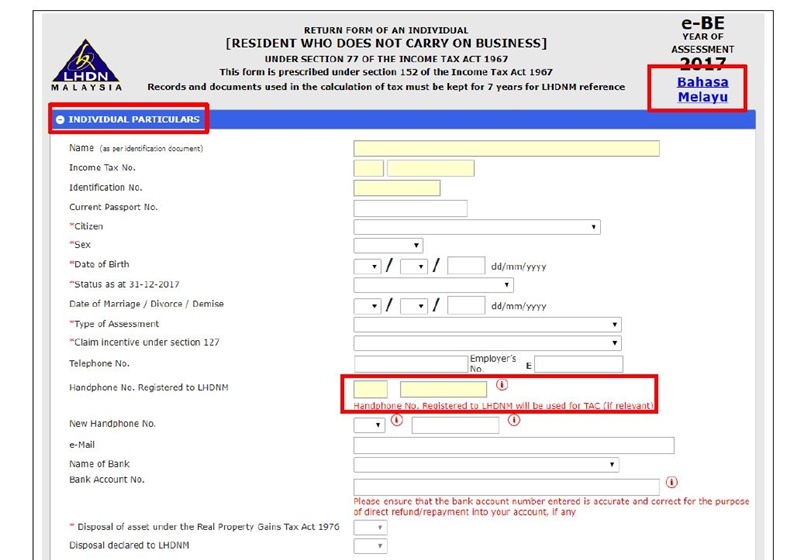

Incentive under section 127. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette. In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Under schedule 6 is still eligible to enjoy the incentive under any gazette order subject to the conditions therein while those granted the specific exemptions under sections 127 3 b and 127 3a would not be. Type of incentives a incentive for ohq an approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources.

Incentive under section 127 of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. Business income income arising from services rendered by an ohq company to its offices or related companies. I enter x in the box for the type s of incentive. I enter x in the box for the type s of incentive.