Income Tax Number Malaysia Example

Sg 10234567090 or og 25845632021.

Income tax number malaysia example. By far online payment is the easiest and most efficient way to pay income tax in malaysia. For example let s say your annual taxable income is rm48 000. Section 3 of the income tax act 1967 ita states that income shall be charged for the income of any person accruing in or derived from malaysia or received in malaysia from outside malaysia the phrase accruing in or derive from malaysia means the source of income must be in malaysia. Year of assessment 2019.

This includes your basic salary commission bonuses etc. All tax returns must be completed and returned before april 30 of the following year. The best would be via the irb s own online platform byrhasil it s the only online platform that supports payment by credit cards visa mastercard and american express so you can earn some points or cashback for paying income tax just note that there is a processing fee of 0 8 imposed for. The most common tax reference types are sg og d and c.

Here are the income tax rates for personal income tax in malaysia for ya 2019 i e. To file income tax an expatriate needs to obtain an income tax number from the inland revenue board of malaysia irb. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type. In malaysia the tax year runs in accordance with the calendar year beginning on january 1 and ending on december 31.

The inland revenue board of malaysia malay. Type of file number 2 alphabets characters sg or og space income tax number maximum 11 numeric characters example. References income tax act 1967. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. The unique reference number assigned to you by lhdn. Example scenario your annual taxable income is rm48 000. Examples of tax rebates in malaysia include tax rebates for zakat fitrah tax rebates for individuals whose chargeable income is below rm35 000 and tax rebates for married couples with joint tax files.

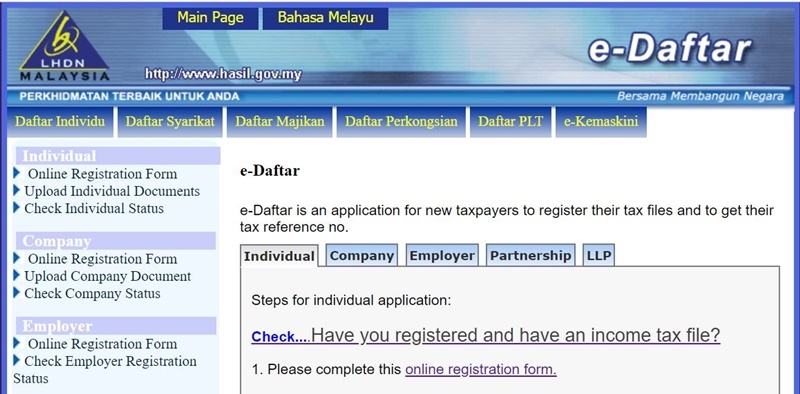

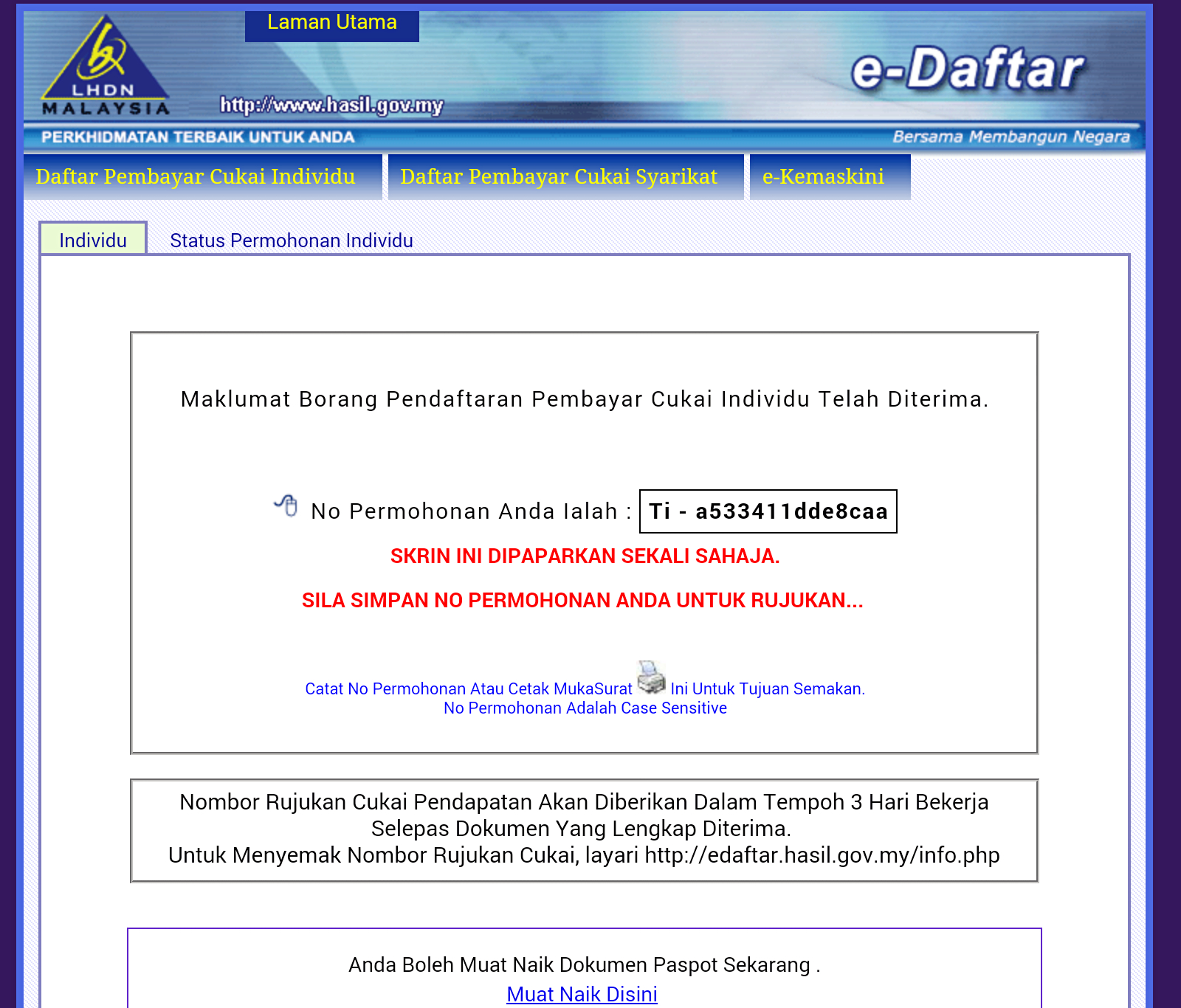

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. To obtain your income tax number you should register online through e daftar or in person. Your income tax number consists of a tax reference type of 1 or 2 letter code followed by a 10 or 11 digit tax reference number.