Joint Assessment Tax Relief Malaysia 2019

Amount rm 1.

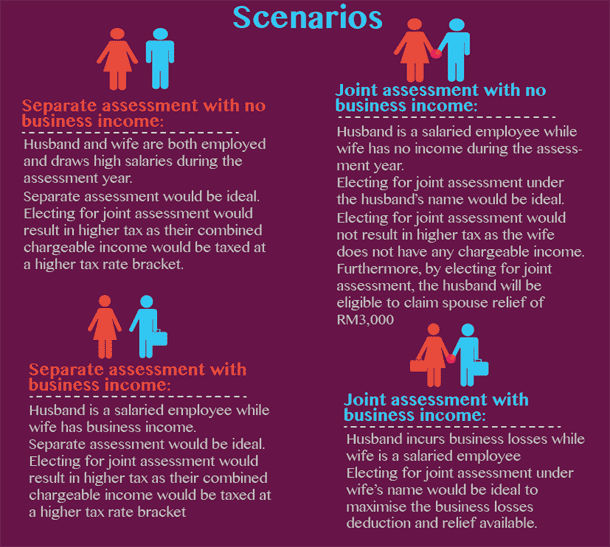

Joint assessment tax relief malaysia 2019. 5 000 limited 3. And if you did a complete medical checkup for you spouse or children you can also claim tax relief of rm500. To refresh your memory the conditions for the tax relief for spouse are that your spouse has no source of income or elects for joint assessment in your name. Depending on the income differences between the spouses claiming joint or separate.

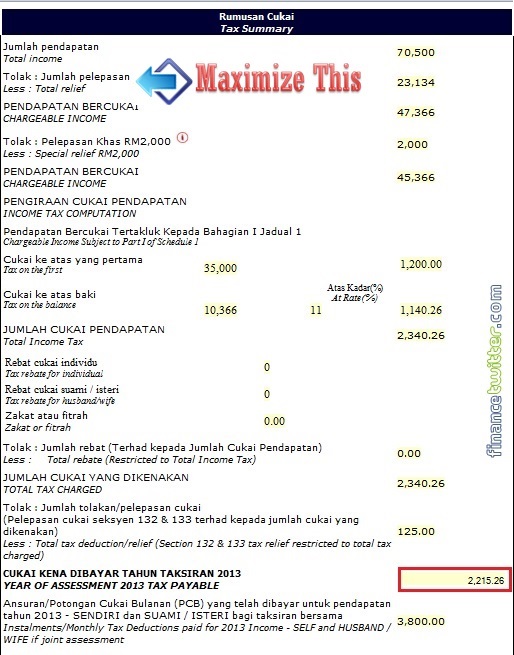

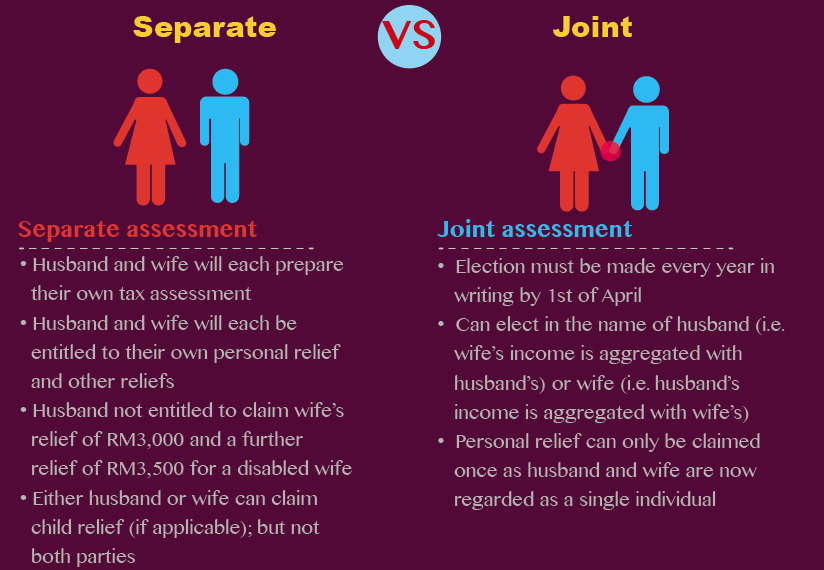

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. One such decision relates to taxes more specifically whether to file separate or joint tax returns. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Here is a list of all the tax reliefs available for income tax filing 2019 in malaysia.

If your chargeable income after tax reliefs and deductions does not exceed rm35 000 and you have been allowed the tax relief of rm4 000 for your spouse you can claim this rebate. Medical expenses for parents. Married couples have a choice to file a joint tax assessment with their spouse as per stated in section 45 of malaysia s income tax act 1967. You need to consider whether to file for joint or separate assessment to maximise on the tax relief such as spouse relief and also which spouse to claim for child relief.

This relief is applicable for year assessment 2013 and 2015 only.